TAMPA PALMS

After three terrible years - with cash running out and debt going unpaid and development obligations becoming more and more delinquent - we still thought we could turn things around.

We still had a very valuable land inventory.

We had just received the permits for two incredible new communities - Tampa Palms and Marco Shores.

There was still ample land inventory in the Three Seasons Communities.

And there were the future opportunities at Horrs Island, Putnam County, and the Dade County property.

In August of 1984 a new strategy was announced.

In the future we would operate as the " Master Developers" expert at planning, permitting and land development and selling build-able parcels to builders.

Simultaneously we would phase out of the installment land sales business.

We would also terminate - for the second time - our home building program.

While it had been forced on us, it was a viable business plan.

The plan allowed us to profit from our land assets with a much smaller organization and without the high selling costs of the past.

As the year wore on Tampa Palms was top priority. All available human and financial resources were focused on its opening - A.S.A.P.!

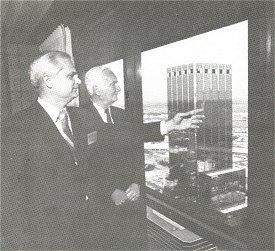

Around May or June of 1984 a ground breaking for the project took place. The ceremony was as opportunity to generate publicity for the new community. To dramatize the event the ground breaking was held on-site with Lieutenant Governor Wayne Mixon and Hillsborough County Commission Chairman, Rodney Colson in attendance and televised back to the "Opening Reception" which was being held in downtown Tampa where 250 guests were waiting. Those of us actually involved in the ground breaking at the Tampa Palms site were helicopter-ed back to the reception making a dramatic entrance - landing on the roof of the downtown tower.

The Deltona Drummer - an in-house publication for employees and affiliates - described the event and the community.

GALA GROUNDBREAKING

FOR TAMPA PALMS

"More than 250 people, including Deltona V.I.P's Hillsborough County officials and community members joined to celebrate the beginning of the Company's $360 million residential development, Tampa Palms.

The new total master-planned community, located about twelve miles northeast of downtown Tampa is expected to accommodate about 30,000 residents. When completed it will have about 13,500 homes, two schools, six churches, two fire stations, a beautiful, fully equipped clubhouse and two golf courses. About seventy acres will be devoted to shopping centers, a hotel and office buildings, and a substantial amount of land will be protected as ecological preserves and parks.

The area is primed to become home for the middle and upper strata corporate executives of Tampa and based on current predictions, there is a potential that everything in the project could eventually sell for $1 billion. "It seems like everything good that could happen to a piece of land has happened to this," said Jim Apthorp, president of the Tampa Palms Corporation.

Frank E. Mackle III, speaking before the large audience which included the Company's Chairman of the Board, Frank E. Mackle Jr., Lt. Governor Wayne Mixon and Hillsborough County Commission Chairman Rodney Colson, donated sixteen acres for an elementary school and seven acres for construction of a Catholic Church. Mr. Mackle also reaffirmed Deltona's "total commitment" to the development of Tampa Palms and the Company's endeavor to work with the people of Hillsborough in developing a community of which they'd be especially proud."

By the end of 1984 everything was in place for the grand opening.

All permits had been received.

Initial road construction was nearing completion.

A general architectural theme - modeled after Augusta National, the site of the Masters golf tournament - had been established .

The entrance was complete.

The sales office - a white clapboard sided, metal roofed masterpiece with 360 degree wrap around porch and old fashioned dormer windows was finished.

The riverfront park on the Hillsborough River was complete.

Negotiations with builders was already underway for the sale of the first parcels.

A massive local advertising plan for the first year was planned. For two or three weeks prior to opening advertising had already been running. Prominent in the program was an expensive professionally produced film describing the future community.

Brochures and other sales aids were produced.

Jim Apthorp, now President of the Tampa Palms subsidiary, had staffed up for the opening.

The Grand Opening for the general public was firmly scheduled for the weekend of January 12th and 13th.

For several years we had enjoyed a relationship with the prominent New York investment banking house, Baer Stearns and with their Richard Fishbein. We had been working with Richard on a financing when Morgan Guarantee stepped in and acquired stock for 12,250,000 in 1983. Later Baer Stearns had been the lead underwriter on a $30,000,000 Deltona Utility, Inc. bond that was completed in December of 1984.

Right after New Years Day 1985 - with the opening of Tampa Palms about ten days away Richard called and said he had someone who was interested in buying the entire community for - Richard Fishbein said - around $40 million cash.

We were stunned!

On one hand we felt our whole future depended on the marketing of Tampa Palms as a Master Developer. Gross sell out of the land alone over the life of the project - perhaps ten years or more - could be $350 million or more - total build-out nearing $1 billion with opportunities for shopping center operations, hotel operations and more.

Unfortunately, we had an immediate and critical need for cash just to stay afloat.

We did not - at the time - even have any long term financial backing for the project.

And $40,000,000 cash was a top - perhaps over-the-top - price for the - nearly - raw land.

The interested party was identified as Ken Good, an entrepreneur, from Denver. Richard Fishbein assured us that he was genuine and not only was capable of a purchase of that magnitude but known to act quickly and decisively.

Ken had made a medium sized fortune in Denver in the Savings and Loan business.

With the opening upon us and ads placed for the grand opening his willingness and ability to move quickly was vital. We would not talk to him unless a deal could be signed within a very few days. He accepted that and the next day we were in full blown negotiations.

The $40,000,000 cash turned out to be a bit of an overstatement on Richard's part.

Within two or three days Ken and I finalized a deal for $37,900,000. He also agreed to purchase 200,000 shares of Deltona stock for $1,000,000. A total of $38,900,000 would be available for debt reduction and other company needs.

The financial pressures that the company was under made it an offer we could not refuse.

Once the basic verbal deal and hand-shake was done it still had to be put in writing. The lawyers had to do their thing.

And time was more critical than ever. We could not cancel the opening on the basis of a verbal agreement.

Ken Good was a very appealing - and persuasive - character. But Ken Good was a hip-shooter. His reputation was that and later events confirmed it. We wanted it in writing with a substantial forfeitable deposit in the event the contract did not close.

The attorneys had less than 24 hours to put the paperwork together.

So the lawyers went to work. There were no significant issues left but there was much to do. All of the legal description had to be put together and so on.

At the end of the day they were not any where close to finishing.

They continued without a break.

The lawyers worked all night.

But Ken wasn't interested in details. He just told his attorneys to "get it done and call me when you are ready".

We told him that we would walk away from the deal if it was not closed by the start of the next business day.

I slept in my office that night for the first time in my life.

Finally - at dawn - everything was ready and Ken was called.

We were all waiting when he arrived in his jogging suit!

The deal was signed. on the morning of January 9th, 1985 ......

...... three days before the Grand Opening!

The Opening was cancelled. Ken had already made it known that he wanted to review the plan of development and reschedule it.

The contract closed on March 29, 1985.

Between the contract and the closing Ken did come back and renegotiate the terms to include a hefty down payment and a mortgage for the balance. Seems he had moved on to other acquisitions and needed the cash for them. We were in control of the matter and the final deal was actually an improvement on the original contract.

We used $20,000,000 to pay down debt.

We designated $10,000,000 to do delayed development work that we were obligated for and we put the balance in to working capital.

Ken went on to purchase of Gulfstream Land Corporation a major developer in Southeast Florida.

A year later - after reviewing the plan and making no significant changes - Tampa Palms opened under the Gulfstream banner.

We went on to other matters.

The new business strategy was still viable even without Tampa Palms.

To solve the Marco permit denial and the subsequent condominium cancellation crisis we had turned to the tremendous land inventory that the Mackles had acquired and added value to over the years.

Hundreds of millions of dollars worth of that land had been consumed in the process.

And yet there was still considerable land asset available - land which was still on the books far below its current value and - with additional investment in land improvements could yield far higher values.

We still had lands in the Three Seasons Communities, Marco Shores, Horrs Island the Putnam county property and the Dade county land.

We also had a nucleus of the best people in the industry who were as dedicated as the Mackles.

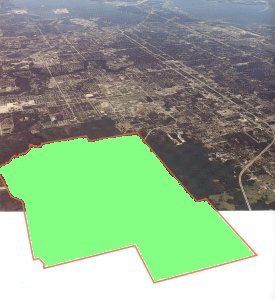

Tampa Palms

Locator Map

Tampa Property

Ground Breaking

Ground Breaking Party

THE VERY BEST of THE BEST

So many other great people had worked for the Mackle family over the years at Deltona.

They include

Neil Bahr

Bill O'Dowd

Billy Vessels

Jim Vensel

Herb Savage

Admiral Fay

John Bonner

Jack Peeples

Ray Anderson

Jim Apthorpe

Roger Everingham

Earle Cortright Sr.

Carol Hinkley

Joe Corbin

Barney Vespucci

Jim Stackpoole

Art Day

Bill Prentiss

Bill Delph

Paul Shaefer

John Mudd

Dave Scharr

Bill Earl

Gaston Bridges

Al Misurelli

Bill Shaughnessy

Ed Torgas

Don Gunn

Bill Peters

Heinz Schmely

Ernie Balint

Art Finney

Ed Grafton

John Abrams

Lee Sanborn

Ed Rogers

Mike Mollis

Ed Oelschlaeger

Michelle Garbis

Arsenio Millian

Gene Linton

Donna Baer

Muriel Choate

and hundreds of others.

And then there was MY TEAM ...

The two people that I worked closest with to solve the Marco Permit denial and to get through those last difficult years - right up to the final days.

I do take some personal pride in the fact that the greatness of the team was demonstrated again and again over the years as they each went on to bigger and bigger business and personal triumphs - one with Deltona and one with Minnesota Power.

To borrow a line from the PGA ....

These guys were good!

Earle Cortright Jr.

and

Bill Livingston

I and the Mackle family are eternally grateful to all of them.

So we moved forward once again.

We had bought time with the Tampa sale.

And planning went forward on all of the remaining land assets.

Marco Shores and Horrs Island were at the top of the priority list.

My pet project was a Sportsmans Club that we were designing for the Putnam County property.

But larger events of 1985 took center stage.

MINNESOTA POWER

By late summer it appeared that we might have a new source of cash -and a partner to build our future with.

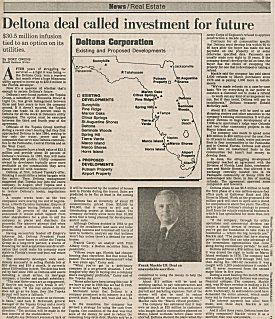

Minnesota Power Corporation was - and is - a major supplier of electricity in the upper mid-west. Minnesota was cash rich but operated in a slow growth area of the country. Their business plan included the acquisitions of utility operations outside of their franchise area. And they were actively looking in Florida. Growth prospects for utilities in Florida must have looked much better than those in the state of Minnesota! The "advance man" for Minnesota Power had made inquiries about acquiring some or all of our utility systems.

Our response was that we were not willing to talk about selling Deltona Utilities but if Minnesota was interested in a position with the parent company and an investment in the future of our real estate and utility operations and all of the other operations, then we would be willing to talk.

Negotiations ensued. They visited us in Miami. We traveled to Minneapolis-St. Paul to meet their people. A deal began to come together.

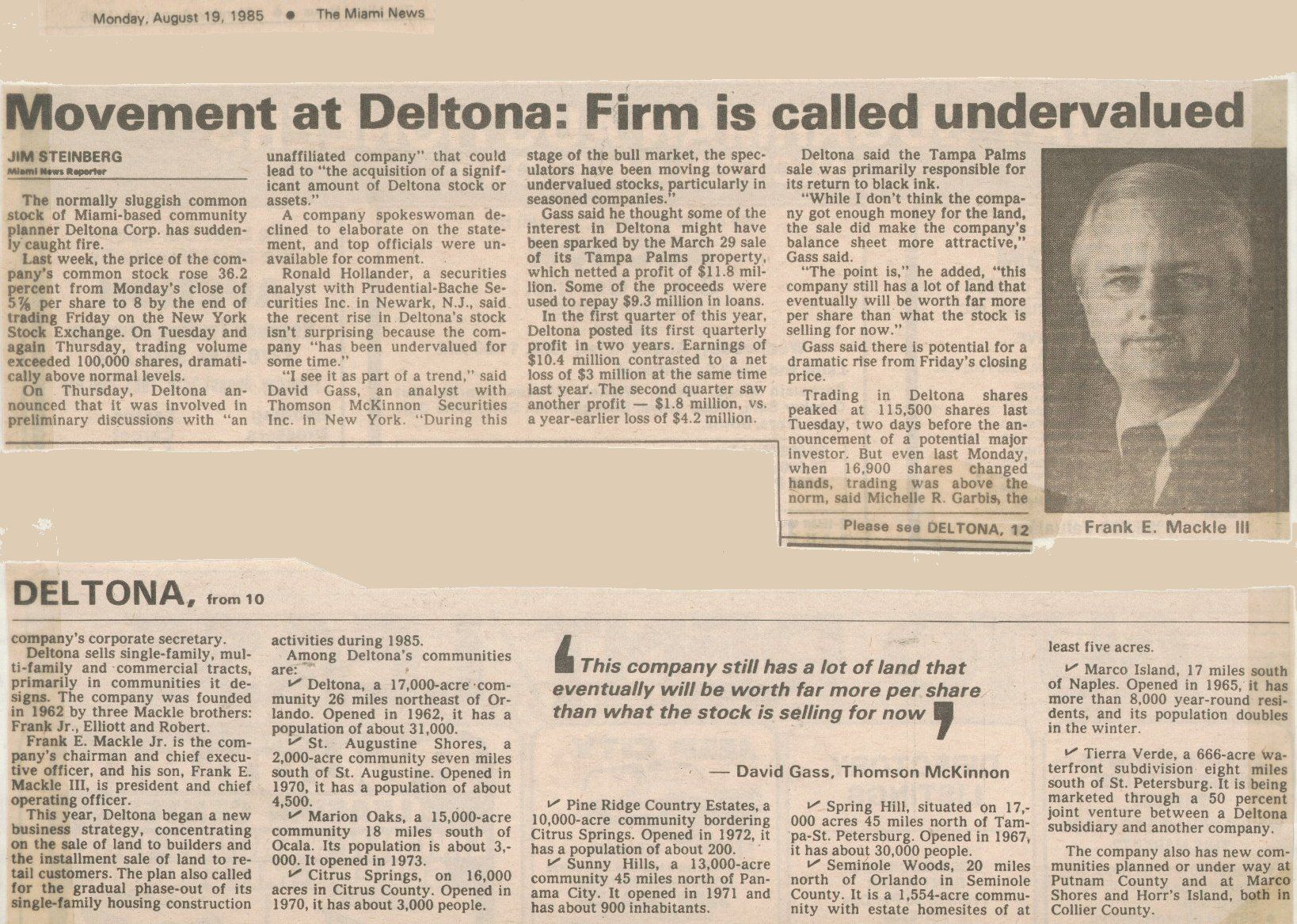

In the mid part of August there was some unusual activity in Deltona stock. We thought that the news of the pending deal might have leaked out. As a result we made public the fact that we were in negotiations with "an unaffiliated company".

By September the structure of an agreement had been reached. On September 11th a public announcement of our Letter of Intent with Topeka Group, a wholly owned subsidiary of Minnesota Power was sent out.

Minnesota would purchase 4,000,000 shares of convertible preferred stock issue for $22,000,000. The stock would have an option - between the third and fourth year - to convert the preferred stock into either common stock of Deltona or they could "cash in" their preferred stock and take 100% ownership of Deltona Utilities, Inc.

In addition Minnesota would make about $10,000,000 in additional funds available to the company either through loans or the purchase of additional stock.

It was a good deal but not one that we would not have made except for the continuing financial pressures on the company. The Utilities was currently generating about $600,000 in profit a year so if Minnesota chose to buy Deltona Utilities they would be paying about 36 times earnings.

The convertible preferred stock would have voting rights so Minnesota would own 43% of the voting shares of the company when the deal finalized. We also agreed that Minnesota could name two directors to the board.

In addition to the cash infusion we believed that we could affect a turn-around in three years and demonstrate to Minnesota that a permanent partnership in all of our operations would be the better choice than opting for the utility company.

THE HOSTILE TAKEOVER ATTEMPT

The deal was near completion when - in early October 1985 the final curtain went up.

We had thought that word might have gotten out about the Minnesota deal which caused the unusual activity in the stock during August.

In a public company major deals like this are done under a strict degree of confidentiality. There are severe penalties for anyone - with knowledge of what is going on - using insider information for personal gain. We had been negotiating for several months and had not made any public announcement about the deal as nothing had been consummated yet. Which had been the reason for the earlier public announcements.

However, the trading activity had nothing to do with the Minnesota deal.

The Securities and Exchange Commission requires that anyone acquiring over 10 % of the stock of a publicly traded company disclose that acquisition.

Around first week of October we received notice that Empire of Carolina - controlled by Maurice Halperin and his son Barry - had done just that. Empire was a toy manufacturer headquartered in Deerfield Beach, Florida.

Immediately contact was been made with Maurice Halperin Chairman and C.E.O. of Empire and its principal owner. A meeting was set up.

Between the announcement and the meeting we contacted Richard Fishbeine as well as our Directors to discuss the situation with them.

We knew from the start we were faced with a bad situation.

Empire had a reputation for making unfriendly takeover attempts and history of acquiring companies, terminating operations and liquidating the assets. Research indicated that they had run afoul of the Securities and Exchange Commission and had been accused of fraud by that body. They had no apparent track record in Florida Real Estate.

Maurice and Barry Halperin came to my office on the sixth floor of Deltona headquarters at 3250 SW 3rd Avenue and Dad and I met with them.

Maurice Halperin was a short stocky man of swarthy complexion. He wore an open necked sports shirt and numerous gold chains around his neck. He was very cocky. Barry Halperin, his son, was of similar build and demeanor.

Dad and I spent less than an hour with them.

We were told that they felt Deltona had a valuable land asset that was not being used to full advantage.

We discussed our plans briefly.

It became apparent that they were totally unaware of our financial situation. They had no knowledge of our cash shortages. They lacked any knowledge of our continuing Marco obligations, the bank debt, our development obligations or any other detail of our business.

The meeting ended fairly abruptly.

They said they would get back to us.

We never talked to them again.

On October 10th Empire filed suit in Miami District Court seeking to stop the Minnesota deal asking the judge to issue a restraining order.

The same day a representative of the toy company disclosed that had now acquired 28.9% of the outstanding Deltona shares!

It turned out that they had - after acquiring stock on the open market - made a private acquisition of the Morgan Guarantee shares that we had sold two years earlier. Morgan had - in effect - cooperated with the Halperins in the hostile takeover attempt.

They further made public their intent to solicit approval from stockholders to remove the present directors of the company and install their own slate of directors. Finally they made public their plan to liquidate the assets of the corporation.

There was no doubt about it - a classic hostile takeover attempt for control of our company was in process!

The Board was brought in to the situation.

Tom McNeill had been a Director of Deltona since 1975 . He was the son of Don McNeill, radio personality and long time close friend of the Mackles. He also was a respected attorney with the major law firm of Mayer, Brown and Platt in Chicago. It turned out that they not only had a section that specialized in securities matters but had an outstanding reputation in dealing with just such matters. We were very fortunate to have such a relationship.

A number of Mayer, Brown and Platt attorneys were put on the case. Leadership was assumed by Alan Saltpeter, a gifted attorney and a dynamic individual. If it were to be cast in a movie Alan might be Han Solo - in an epic battle against the Evil Empire (of Carolina)!

The focus of the next four weeks would be totally on fighting the hostile takeover attempt. We and our attorneys - working in Miami, Chicago and Delaware, where the company (C.K.P.) was incorporated - literally worked eighteen hours a day and seven days a week until it was concluded.

It looked very bleak at first.

At the direction of our attorneys - we moved quickly.

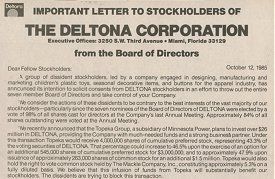

Two days after Empire made their announcement - on October 12th - we sent out a a Letter to Shareholders and published full page copies of it in major newspapers including the Wall Street Journal.

On October 24th Empire sent out "consent" material to Deltona stockholders seeking their vote for Empire's plan to take over the company, establish a new board and begin the liquidation of the company.

The proxy fight was on!

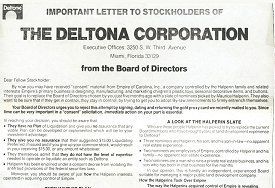

On October 30th we sent out our own consent forms seeking stockholder support and making our arguments.

Prior to the Minnesota deal there were 5,233,000 voting shares outstanding. The Mackle Company held about 520,000 shares of the company's stock or about 10%. The Halperins owned at least 28.9 %. The stock had been selling for between 4.25 and 10.00 for the last year or two. Halperin was saying that liquidation would yield at least $15 per share. Winning a proxy fight would be difficult.

But, if the Minnesota deal could be completed there would be 9,233,000 shares outstanding. Minnesota and the Mackles together would own about 4,520,000 shares or 49% and the Halperins would be reduced to 16%. The proxy fight would be ours.

At issue was the question of how the record date for stock ownership would be established.

Our Board voted to set November 18th as the record date - time enough, we thought, to complete the Minnesota deal.

The Halperins contended that they could set the record date as of October 7th, which would exclude the Minnesota votes.

The Halperins filed suit in Delaware challenging our November 18th "record date".

Their were three questions to that had to be resolved.

- Could we win the Miami case that Halperin had filed to block the Minnesota deal?

- Could we win the case in Delaware to decide whose stock would be counted in the proxy fight?

- Could we keep the Minnesota deal together and close it in time?

Minnesota Power was a very conservative mid-western utility company. Their very entree into the Florida real estate business was an adventurous move for them. A final deal had not been signed. Minnesota had only signed a non-binding Letter of Intent. Their "due diligence" had to be completed. Minnesota faced the prospect of finding themselves in partnership with the unknown and obviously aggressive Halperins. And the deal had to be close before November 18th. Minnesota could back out of the deal any time. Or delays could easily occur - not too unusual on a deal of this size.

We had to be successful with on all three fronts or our Board would be replaced and the company would be liquidated.

The October 30th Letter to Shareholders addresses all the reasons we felt that Halperin's plan of liquidation was was a mistake for stockholders. It pointed out Halperin's track record and lack of knowledge about the business. It pointed out the benefits of the Minnesota deal to stockholders.

It would also be disastrous to Marco customer obligations, Three Seasons lot deliveries, our bank relationships and our relationships with environmental and land sale regulatory authorities - not to mention Deltona employees.

The Delaware case was argued by lawyers over purely legal issues over the setting of a "record date". It would proceed without significant publicity.

The Miami Case was very different.

Alan liked to use the recently popular "Rocky" film as the "context" for our uphill battle. And - as I was being prepped for a two day court testimony and cross examination - he began to joke about me being "Rocky Balboa" ..... maybe it was because I was very "out of shape" at the start! In any event - after his long and exhausting prep sessions I was ready to enter the ring.

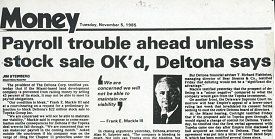

The court case was heard before Judge Stanley Marcus in the Federal Courthouse in downtown Miami. The trial started on Friday, November 1st and lasted two days. I was on the witness stand all of Friday afternoon and most of the Monday morning. For the first time in my life it was necessary to dramatize the "down side" of the company's situation. We had to convince the judge that the Minnesota deal was real....that we did not bring them in just to ward off the takeover attempt. And we had to demonstrate the looming company disaster if the Minnesota deal was not completed.

I was examined and cross examined.

The press latched on to the testimony of possible bankruptcy.

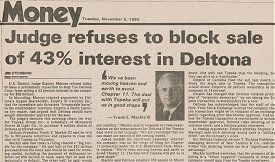

On Tuesday, November 5th we received news that the Judge Marcus had ruled in our favor in the Miami case. Halperin's effort to obtaining a restraining order against the Minnesota deal was denied.

We had our first victory!

In Delaware at the same time our Chicago lawyers argued the "record date" issue.

On Wednesday November 6th we received news that the Supreme Court in Delaware, in a unanimous opinion, ruled that the company was proper in its setting the "record date". I was out of the office when the news came. I was greeted by a hand made sign on my door, "We Won in Delaware!"

It was the second - and deciding - court victory.

In the meantime Bill Livingston, Earle Cortright and Arsenio Milian had held Minnesotas hand tightly! The due diligence had been completed. Minnesota had "hung in there". We were ready to close.

On Friday, November 8th, we completed the deal with Minnesota Power.

We had won by a knockout!

At the end of the movie, Rocky, there is a great victory celebration.

I don't remember celebrating.

It was too exhausting.

So the final year under Mackle leadership was one of significant accomplishments.

The Utility financing in December, 1984 had put $30,000,000 in to Deltona coffers. The Tampa sale earlier in the year gave us $39,000,000 to reduce bank debt, meet development obligations and invest in the future. And the Minnesota deal gave us $32,000,000 - and a partner with "deep pockets" with whom we would re build the company. We had raised over $100,000,000 in twelve months.

And the company - largely as a result of the Tampa Palms deal - for the first time in four years - reported a profit.

THE FINAL CHAPTER

But - for the Dad and I - the end was near.

During the Minnesota negotiations Dad - now age 69 - had announced his intention to retire from Deltona and concentrate on the Mackle Company.

Minnesota Power had been referred to as Deltona's "white night" in the battle with the toy makers.

It did not turned out that way.

I have always thought that the "full court press" that the hostile takeover demanded made us miss an important phase of the Minnesota Power courtship. We were never able to get to know each other. I never had time to sit down and discuss my plans, my goals, my intentions for the company and listen to their thoughts and plans. We never put together or even outlined an agreed on business plan. We went from middle level negotiation of the "deal" to agreement without ever having those types of heart-to-heart discussions. The battle that ensued with Empire of Carolina kept us from it.

Our only thought with Minnesota was to keep them in the deal at any cost. We absolutely had to complete the deal with them in order to block the Empire takeover.

Minnesota was satisfied with the acquisition of the utility company - it was their "worst case scenario" and that was fine with them.

We hoped we could show them - in the three year engagement - how lucrative the real estate side of the business could be - and the three year engagement would become a permanent marriage.

We never had a chance and I don't believe they ever contemplated that possibility.

It was obvious from the start that Minnesota had two priorities.

To limit their own liability.

And to bide their time for three years and then exercise their option on the Utility company.

But the deal was done.

Roger Bowman was Chairman of the Board.

Jack McDonald of Minnesota Power was named to the board.

---------------

Perhaps it was that I was exhausted from the events of the past three years.

Perhaps it just wasn't a Mackle company any more.

Perhaps I sensed a lack of personal support from Minnesota Power.

I thought - at age 41 - that the world was full of better opportunities.

I discussed it with Dad...and he understood.

And on March 4, 1986 our resignations were officially accepted by the Board.

I agreed to stay on the Board.

I felt an obligation to my friends still with the company.

Two subsequent events changed that...

The hiring of Bill Avella - former General Development executive - as President.

And Minnesota's decision to invite the Halperins to join the Board!

I walked out in the middle of that 1986 board meeting.

It was all over.

Note on my door

November 6, 1985

THE AFTERMATH

The accomplishments of the past year and a half left Deltona financially sound and with strong ownership in the form of Minnesota Power.

A number of new business plans could have been adopted.

Bill Avella was enamored of the success that General Development was having selling lots on the basis of their "equity trade-up" program.

And Deltona had a large inventory of unsold lots in their Three Seasons Communities.

So he and the new Board - headed by Chairman Roger Bowman and Director Jack MacDonald from Minnesota Power chose to turn Deltona back in the direction of installment land sales using General Development methods as their model.

Rebuilding the Franchise and Branch office network was again the focus of the company.

There was some success at first.

In 1986 the company reported a loss of $1,825,000 - considerably better than 1985 excluding the Tampa Palms sale.

In 1987 the company reported a profit of $566,000

In 1988 the company reported a profit of $725,000

In 1989 the company reported a profit of $3,716,000

In the late 80s however executives of General Development were charged - and later convicted - with fraud related to their installment land sales practices. General's operations were shut down and they eventually sought bankruptcy court protection. Although the ruling was later overturned on appeal the principles of General Development were sentenced to prison.

Deltona - and Minnesota Power - saw the writing on the wall.

In mid 1989 Minnesota bailed out, exercising their option to acquire Deltona Utilities, Inc. in exchange for their stock in The Deltona Corporation.

The Halperins were now the largest stockholders of Deltona and took over control.

In 1990 the company lost $17,000,000.

In 1991 the company lost $19,500,000.

In 1992 the company lost $6,700,000.

In mid 1992 the Halperins sold their interest to a Belgian investment group headed by Tony Gram a Belgian contractor.

Today (2001) - in spite of continuing losses - the company still exists. They reportedly are down to a dozen or so employees. They have moved their headquarters to Marion Oaks. The company trades on the Over The Counter Market at less than $1.00 per share.